Small business credit cards offer myriad benefits: rich rewards and flexible credit lines with credit limits that are often higher than on personal cards. Plus, there’s an added bonus that small business owners don’t always recognize at first: A business credit card may help you build business credit.

Getting one of these cards may help put your business on the map when it comes to building business credit, provided the card issuer reports information to commercial credit agencies. Not all cards have the same policy when it comes to reporting to business credit bureaus, though, and it’s important to understand how each one works. (In a separate article, we explain how business credit cards may affect a business owner’s personal credit.)

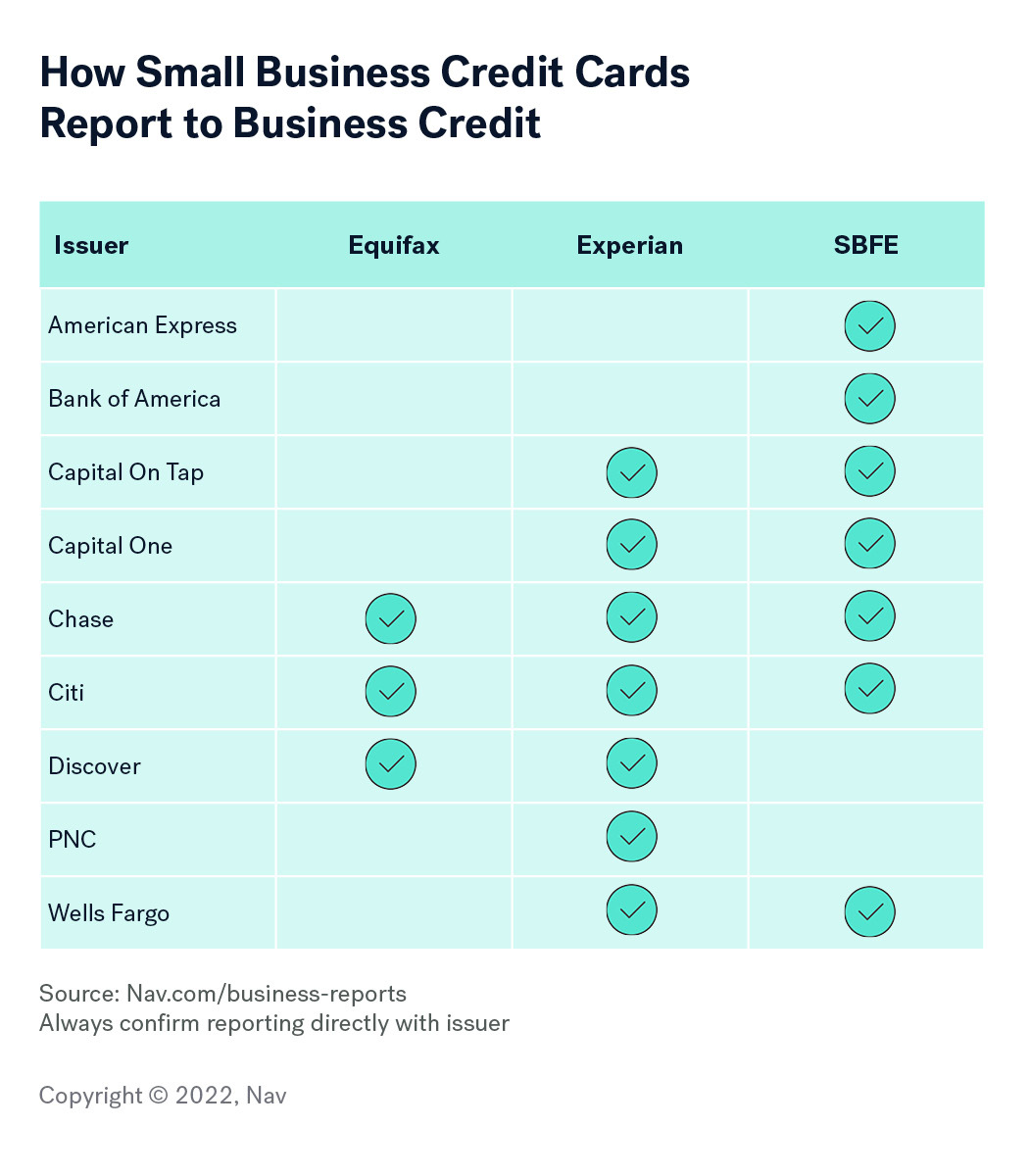

How Business Credit Cards Report to Business Credit

There are a number of commercial credit reporting agencies in the U.S. Separately, the Small Business Financial Exchange (SBFE) serves as a repository of business credit information for its members, which include major financial institutions and lenders of all types that provide financing to small businesses.

The SBFE doesn’t compile or sell credit reports. Instead, it works with SSBFE Certified Vendors, which are credit reporting agencies that are permitted to include credit information reported to the SBFE exchange in the reports they sell to members of the SBFE. SBFE Certified Vendors currently include major business credit bureaus like Equifax and Experian.

SCredit reporting is entirely voluntary. No issuer is required to report information to credit bureaus, whether it’s personal or commercial credit information. And with business credit in particular, it can be difficult to find lenders and vendors that report. That’s why having a credit card that reports can be so helpful.

We reached out to major business credit card issuers for details on where they report small business credit card payment history. The chart below summarizes findings.

Information may also appear on credit reports from bureaus not listed below. One reason is due to the SBFE Certified Vendor model. Information reported to SBFE may also be included in reports compiled by SBFE Certified Vendors.

Issuer policies may change. Be sure to check with the issuer for current information on credit reporting policies.

How to Get a Business Credit Card to Build Credit

Small business credit cards are available to small business owners with good personal credit scores and sufficient income to meet the issuer’s minimum income requirements. A few important qualifiers to keep in mind:

- You will almost always need to provide your social security number when you apply, and there will be a personal credit check. Most issuers require at least a good personal credit history to qualify, and that usually means you need a FICO score of 650-680 or above to qualify. Some cards require excellent personal credit scores to qualify.

- There is almost always a personal guarantee required as well. You may be asked for some basic information about your personal finances (such as income).

- Startups, freelancers, contractors and sole proprietors may qualify as long as you meet the issuer’s requirements.

- It’s a good idea to get an Employer Identification Number before you fill out a credit card application to help ensure your new card gets reported properly under the name of your business.

What to Look For in a Credit Card to Build Credit

Business owners looking for a credit card have many choices. Your primary goal may be to build credit, but that doesn’t mean you should overlook other benefits of small business credit cards:

Rewards: Think of all the money you spend in your business, then think about all the credit card perks you may earn if you use a credit card to pay for those business expenses. For many businesses, it adds up quickly.

Cash back rewards are universally popular, as business owners can always use cash! Some cards offer bonus cash back for spending in bonus categories (such as office supply stores) so it’s helpful to review your typical business purchases before you choose a card. Points are also popular, and are most often used for travel, but can be redeemed for other rewards such as gift cards.

Financing: Don’t overlook the fact that a business credit card is essentially a line of credit your business can use when needed. Unlike a business loan, no one will question why you need financing. Some cards even offer balance transfers or introductory APRs of 0% for a year or longer. That low-cost financing can be very helpful to new businesses or any business that is experiencing tight cash flow.

It’s essential, though, that you use this financing for essential business spending. Otherwise you may find your business with a credit card balance at a high interest rate once the introductory rate expires.

4 Best Business Credit Cards to Build Credit

If your goal is to build business credit, while enjoying the benefits small business credit cards offer, here are five card offers to consider:

1. Chase

Chase reports to all the major commercial credit reporting agencies, making it a good choice if you want to build business credit. The Chase Ink Business Preferred® Credit Card is a particularly attractive card. It offers a generous sign-up bonus: Earn 100,000 bonus points after you spend $15,000 on purchases in the first 3 months from account opening.. That’s $1,000 cash back or $1,250 toward travel rewards when you redeem through Chase Ultimate Rewards®, their travel portal.

Ongoing reward points are solid as well: Earn 3 points per $1 on the first $150,000 spent in combined purchases on travel, shipping purchases, Internet, cable and phone services, advertising purchases made with social media sites and search engines each account anniversary year. Earn 1 point per $1 on all other purchasesâ€"with no limit to the amount you can earn.

- Shipping purchases

- Advertising purchases made with social media sites and search engines

- Internet, cable and phone services

- Travel

Earn an unlimited 1 Point Per $1 spent on all other purchases. Points do not expire as long as the account is open. You can also get free employee cards.

The annual fee is $95 and there are $0 foreign transaction fees.

FAQs

Can a Personal Credit Card Build Business Credit?

The answer is “no”, a personal credit card will not build business credit because it will not appear on business credit reports. To build business credit, you’ll want to choose a small business card that reports to business credit.

Can you get a business credit card with a 600 credit score?

Most business credit cards require good or excellent credit to qualify. If your credit scores are below 650, you may need to consider a secured credit card or other options to build business credit, such as net-30 vendor accounts.

How can I build my business credit fast?

The fastest way to build business credit is to establish accounts with companies that will report your payment history, including business credit cards, business loans and vendor accounts. (Not all of these companies will report, so be sure to check before you apply.)

Hi

I’m just starting a business and I don’t have any income coming in for it yet. Which credit card or product would you recommend to get started to buy things for the company?

Most small business credit card applications will allow you to include income from all sources, not just the business. If you have income from other sources that could help you qualify.

I have two vendor accounts that are not reported on my business report. How do I get these accounts added to my business report through my Established Business plan with Nav?

Unfortunately Nav cannot report other vendors accounts. (We report for our customers with Business Boost or Business Loan Builder accounts.) You’ll need to ask those vendors to report directly to credit bureaus.

I’m looking at the capital one spark cash select business card. Do you have any idea what credit is needed?? I’m getting so many different scales on the internet. Thank you

The issuers aren’t eager to publish minimum credit scores (and the score you see may be different than the one they use). It may help to have a Nav account and see which cards are a good match. It’s not full preapproval but it should help to get you in the ballpark.

Capital one spark did not approve me due to a open bankruptcy on my personal credit

I’m sorry to hear that.

Hi I just heard about Nav , I have a decent credit FICO 740; also I have my LLC company with out credit history since 2007 was launched, my question is about create a credit to my company with just my EIN and create a trade lines separate from my personal credit, it’s possible?

Thanks

Yes try capital one spark.